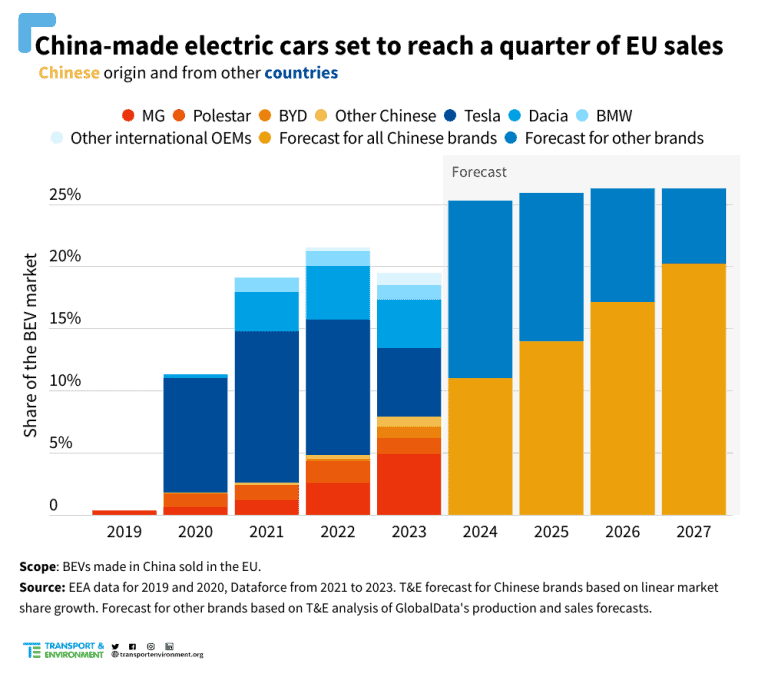

The Brussels-based European industry lobbying group, Transport & Environment, dedicated to the development of green transportation, recently stated that nearly one fifth (19.5%) of electric vehicles sold in Europe last year were made in China, and this figure is expected to reach one quarter (25%) by 2024.

This prediction comes as the EU is considering imposing import tariffs on electric vehicles manufactured in China, to offset the competitive disadvantages brought about by subsidies to the Chinese electric vehicle industry. Transport & Environment suggests that the only way for European car manufacturers to compete with Chinese brands is by increasing the production of electric vehicles for the mass market and investing in the European battery supply chain, though tariffs could also contribute to the localization of electric vehicle manufacturing.

Despite the fact that a significant portion of the cars exported from China to Europe are from Tesla, Dacia, and BMW, Transport & Environment predicts that Chinese brands will hold an 11% share of the European electric vehicle market in 2024, and this figure is expected to rise to 20% by 2027.

Data indicates that by 2023, electric vehicles made in China will account for nearly 20% of the sales share in Europe, with projections suggesting this will exceed 25% by 2025. Among them, Chinese brands led by MG, Polestar, and BYD are expected to reach 11% in 2024 and 20% by 2027. (Source: Transport & Environment organization)

Julia Poliscanova, the senior director responsible for vehicles and e-mobility supply chain at the organization, stated: “Tariffs will force car manufacturers to localize electric vehicle production in Europe, which is a good thing as we need these jobs and skills. But tariffs won’t protect traditional car manufacturers in the long run. Chinese companies will set up factories in Europe, and our automotive industry needs to be prepared for that.”

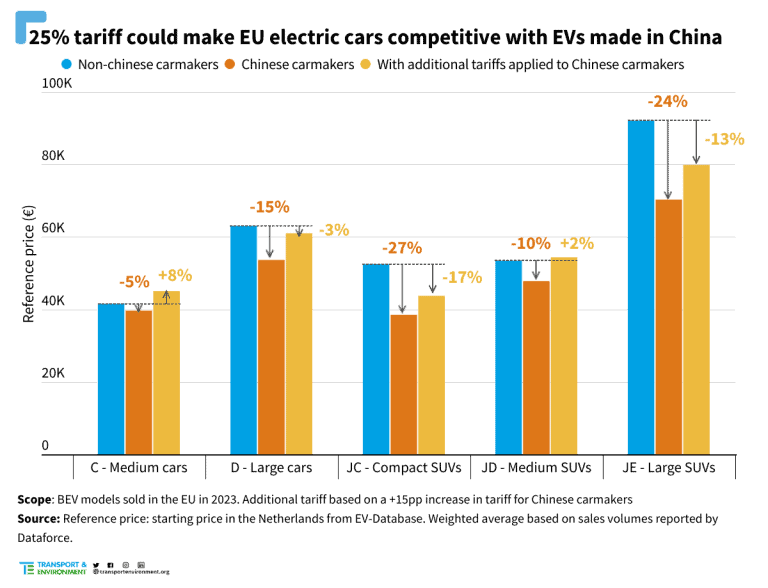

The report by Transport & Environment found that if the EU imposes a 25% tariff on all cars imported from China, mid-sized sedans and mid-sized SUVs from China would become more expensive than their European counterparts. However, under such tariffs, compact SUVs and larger vehicles imported from China are expected to remain slightly cheaper than similar European products.

In the graph, blue represents the price of electric vehicles from non-Chinese brands, orange represents Chinese brand electric vehicles, and yellow indicates the price of Chinese brand electric vehicles after imposing a 25% EU tariff. The report’s analysis suggests that imposing a 25% tariff will make the prices of mid-sized cars (C-segment) and mid-sized SUVs match or even exceed those of similar European models, while large cars (D-segment), compact SUVs, and large SUVs will still be cheaper than their European counterparts. (Source: Transport & Environment organization)

The report emphasizes that the EU should not aim to protect its car manufacturers from meaningful competition, which would limit the supply of affordable electric vehicles to Europeans. While raising tariffs, it is more important for regulators to push for an increase in the production of electric vehicles locally, including achieving the electrification targets for corporate fleets by 2030, beyond the agreed goal of 100% clean cars by 2035.

However, investment in lithium-ion batteries faces risks, as batteries manufactured in China are at least 20% cheaper than those made in Europe, and Chinese battery manufacturers lead in technology and supply chain. The United States has also attracted battery investment through significant subsidies. The organization believes that Europe needs to take strong industrial actions, such as subsidies for clean and circular manufacturing and “Made in EU” targets, to boost local battery production. Since these are not yet in place, the introduction of tariffs on imported batteries should be considered. Compared to the United States and China, the EU currently has the lowest tariffs on batteries.

Julia Poliscanova stated: “Batteries are the new solar power. China is in the lead. If we are serious about addressing the issues of a diversified and resilient European battery supply chain, we need to act now. We won’t get a second chance.”

Welcome to CHINA VAST GROUP, a distinguished enterprise established in 2005. As a leading service provider in China, we specialize in international logistics and supply chain services, with a commitment to innovation, mutual benefit, and win-win partnerships. We operate through three principal divisions: CHINA VAST LOGISTICS CO., LTD., VASTFORTUNE STORAGE AND TRANSPORTATION CO., LTD. and VASTREACH SUPPLY CHAIN CO., LTD., each dedicated to excellence in their fields.