Today, on August 29, Amazon’s Small and Light Program has officially exited the stage on Amazon.com in the United States. The European site is also set to close at the end of the upcoming month.

Less than a year after the introduction of Temu, Amazon has taken action against the Small and Light Program twice. The first instance occurred in November of last year when Amazon notified sellers that the price cap for the program would be increased from $10 to $12 starting this year. Many industry insiders interpreted this move as a response to Temu’s low-price strategy. In retrospect, this strategy did not yield the expected results. Within a span of less than six months from the policy change, Amazon decided to completely discontinue the Small and Light Program, aiming to compete with Temu by emphasizing quicker delivery times and lower prices.

What is the Amazon FBA Small and Light Program?

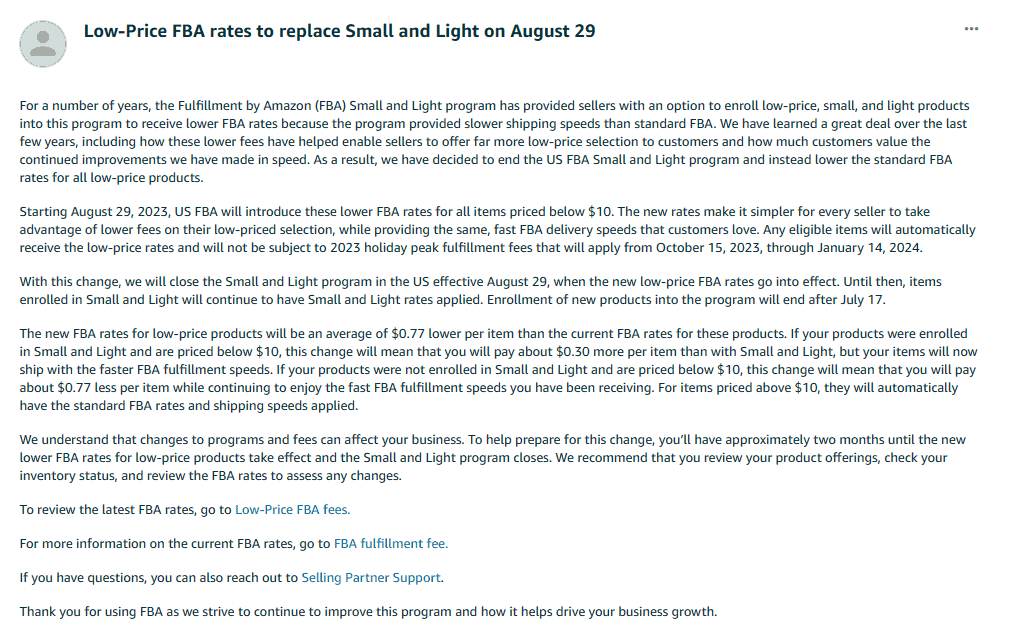

The Small and Light Program allowed sellers to offer smaller, lighter, and more affordable products with reduced shipping costs. Regular Amazon FBA fees often rendered the sale of low-priced items unprofitable. However, the Small and Light Program mitigated shipping costs for products that met specific criteria, encompassing weight, size, and price. Nonetheless, this reduction in shipping costs was accompanied by longer delivery times compared to standard Amazon logistics.

Today marks the conclusion of the Small and Light Program on Amazon.com, with the new Amazon logistics fee rates for low-priced goods now in effect. Notably, the program had ceased accepting new product registrations as of July 17.

The cessation of the program will bring about the following changes:

It’s important to note that the majority of products priced below $10 were enrolled in the Small and Light Program. Consequently, Amazon’s decision is likely driven by two primary objectives: increasing shipping fees and pressuring products priced between $10 and $12 to lower their prices.

The discontinuation of the Small and Light Program isn’t exclusive to the US site. The European site’s program will also close on September 26. This transition will introduce new low-price logistics fee rates across eight major European sites. Until then, products registered under the program will continue to adhere to program fee rates. New product registrations for the program will cease after September 14. The price thresholds for the European sites are as follows:

The announcement of this policy change has led many sellers to report significant declines in profits. While their initial strategy was to capture market share through low prices, Amazon’s unexpected about-face disrupted these plans. Sellers with prices ranging from $10 to $12 were particularly affected.

Despite the challenges faced by sellers, Amazon proceeded with these significant reforms. A closer look at the current competitive landscape reveals that Amazon’s actions ultimately revolve around addressing the impact of Temu. Since competing solely on price presents challenges, Amazon is focusing on enhancing delivery speed as a strategic opportunity.

Directly competing with Temu on price would put immense pressure on Amazon. For instance, a retro polka dot dress was priced at $43.99 on Amazon compared to Temu’s price of $13.58, resulting in a substantial $30.41 price difference. However, Amazon managed to leverage faster delivery times as a competitive advantage. While delivering to the same address in New York City took Amazon just one day, Temu required a week.

This distinction underscores a positive impact from the platform’s perspective. However, for sellers, beyond the increase in shipping costs, the mid- to high-ticket product market will also experience indirect effects.

At present, Amazon appears to be exerting pressure on sellers with prices between $10 and $12. Should these sellers opt to reduce their prices, competition in the sub-$10 product market will intensify. It’s widely recognized that the low-value product market is already fiercely competitive, with thin profit margins. The entry of additional players is likely to exacerbate this competition.

Consequently, some sellers have expressed their intent to disengage from the low-value product market and are considering focusing on higher-ticket items. In this light, the discontinuation of the Small and Light Program indirectly contributes to heightened competition in the mid- to high-ticket product market.

In summary, while Temu is having a direct impact on Amazon’s low-value products, over the long term, mid- to high-ticket products will also be influenced to a certain extent.

In this challenging year, Amazon sellers have navigated the dual challenges of economic downturn and the influence of Temu. Nonetheless, there is positive news as the global e-commerce market, previously obscured by uncertainty, is beginning to show signs of clearing up.

Insider Intelligence, a market research firm, recently projected that global e-commerce sales will grow by 8.9% this year and 9.4% next year. This marks a return to stability and predictability following a period of uncertainty spanning three years.

Insider Intelligence‘s forecasts for the retail market encompass the following:

In conclusion, while the global retail sector’s outlook is encouraging, it’s important for retailers to adjust their expectations and embrace a new normal characterized by “good but not great” annual growth.

Welcome to CHINA VAST GROUP, a distinguished enterprise established in 2005. As a leading supplier in China, we specialize in international logistics and trade with a commitment to innovation, mutual benefit, and win-win partnerships. We operate through four principal divisions: CHINA VAST LOGISTICS CO., LTD., WELLUCKY INTERNATIONAL TRADING CO., LTD., VASTFORTUNE STORAGE AND TRANSPORTATION CO., LTD. and VASTREACH SUPPLY CHAIN CO., LTD. Each dedicated to excellence in their fields.