The report stated that the ports where these dockworkers are employed handle about half of the U.S.’s maritime cargo, which could mean a capacity challenge for the global container fleet.

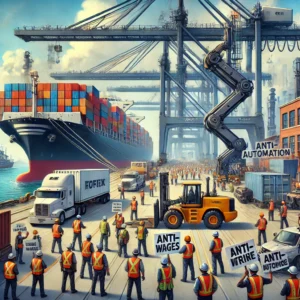

In a statement, the International Longshoremen’s Association (ILA) said that tens of thousands of dockworkers from Maine to Texas have united like never before, determined to negotiate a new contract with the U.S. Maritime Alliance (USMX), which represents the employers. In two weeks, they are preparing to strike, demanding wages that match the billions of dollars in profits made by shipping companies and fully banning the automation of equipment used for loading and unloading cargo at 36 U.S. ports.

According to the report, the top-tier base wage for U.S. dockworkers is $39 per hour, with an annual salary just over $81,000. Including overtime and other benefits, some dockworkers can earn over $200,000 a year.

Sea-Intelligence estimates that for each day of the strike, it may take at least four to five days to “clear” the backlog and restore normal operations. Data shows that a one-week strike starting on October 1st could lead to severe congestion lasting until mid-November, while a two-week strike may mean that ports won’t return to normal operations until 2025. This will affect over 50% of U.S. container cargo imports.

If the strike lasts only a few weeks, U.S. consumers may not experience a severe shortage of retail goods. However, if it continues for more than a month, some consumer products could become scarce.

The report also mentioned that some shipping companies have already diverted cargo to the West Coast to avoid the strike. HSBC analysis indicates that ports along the U.S. East Coast and the Gulf of Mexico account for 54% of U.S. container imports, and up to 15% of the global container fleet could be affected by the strike. The bottleneck at East Coast ports could lead to a capacity challenge for the global container fleet.

According to U.S. Department of Agriculture (USDA) data, the U.S. imported a total of 855,000 tons of beef from January to August 2024, a year-on-year increase of 17%. Beef exports from countries like Canada, Mexico, Brazil, and New Zealand could be affected by the strike. In terms of pork, Mexico and Canada account for 45% of total U.S. pork exports, but more than half of the remaining export markets rely on sea transportation.

According to the latest PIERS data, six of the ten largest U.S. pork export ports will cease operations due to the strike.

If the strike happens, the U.S. meat import and export business will inevitably be impacted, which could affect international meat prices. Exporters and freight forwarders with recent plans to ship goods to the U.S. should closely monitor the situation to avoid unnecessary losses.